Currency trading, Which is often referred to as Forex or foreign exchange, is the transaction that involves purchasing and selling of currencies. This is normally done with the objective of making profits. Forex trading is the largest market in the world. All currency trading is done in pairs. Quite different from the stock market, where you can buy or sell a single stock, you have to buy one currency and sell another currency in the Forex market. Nearly all currencies are priced out to the fourth decimal point. In simple terms, the objective of trading Forex online is to make money. Big Corporations sometimes use it to offset a contract or future purchase that they plan to make. Retail traders tend to book their profits from the different value of the currencies over a period of time.

Lakshmishree Investments & Securities Ltd (LISPL) is one of the quickest growing Stock Broking companies in India. Further, providing you with the appropriate guidance in this exciting world of the Stock Market, LISPL ensures to aid you with the ideal trading solutions. With the decades of our existence and the membership with BSE, NSE, MCX, and Depository Participant with CDSL, Lakshmishree Investment & Securities Ltd is on the urge of providing people with the Stock Trading services throughout Pan India by encouraging and facilitating every Indian to decide for their Investment structure and educating them to self-trade. Subsequently, having the in-house core Research team who dedicatedly works to assist our clients to guide them to invest in the selected stocks based on their risk and returns, LISPL renders quality research outcomes to different classes of clients as per their preferences and requirements.

To manage your risk while trading in the Stock Market, Hedging plays the role of cover-up in the situation.

We have set a low margin requirement for the initial amount which is required to deposit into your margin account before you start your trading on margin or selling short.

Forex Trading is also a platform provided to you when it comes to easy trade in the FOREX Market i.e. dealing in the exchange of currencies.

The Internet is now almost being a part of every aspect of our lives, and so we ensure to deliver you with hassle-free trading with our quality platforms of App & Web.

With the powerful real-time trading terminal, we ensure to offer you with Fast and Efficient Trading services throughout your journey with us.

To reduce your overall risk in the Stock Market, the diversified portfolio will help you invest in various investment sectors.

Here is LISPL we ensure to serve you with the best back-end support services round the clock to let you trade smoothly.

To deliver you quick services with regard to trade understanding or on the technical side, the team at LISPL is always available to get you through.

You can also opt for live chat support with our team that is basically set to resolve any of your queries.

Open today Free trading and demat account

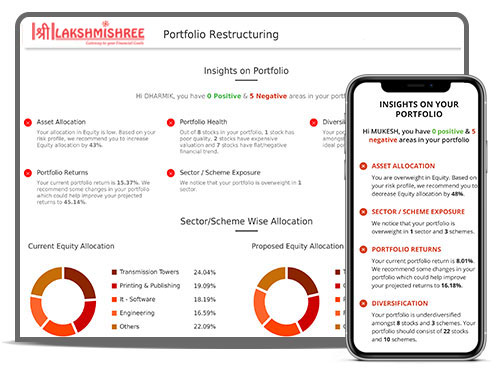

With the decades of our presence in the Stock Market, we admire the trust you keep with us. Whereas, Investments are not just the capital for your returns but they are the stability of your future times. Therefore, maintaining your portfolio appropriately will robustly help you gain utmost stability for your profit bookings.